+180,000 assets

Instant insights

Maximize compounding

Your Portfolio, Fully Understood

Get clear insight from complex financial data

Covering over 180,000 assets globally, connect your broker accounts and get detailed insights instantly.

Built on trusted data from the industry's most reliable sources

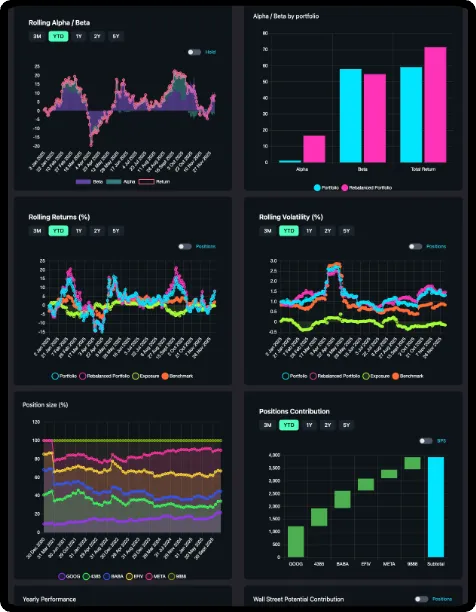

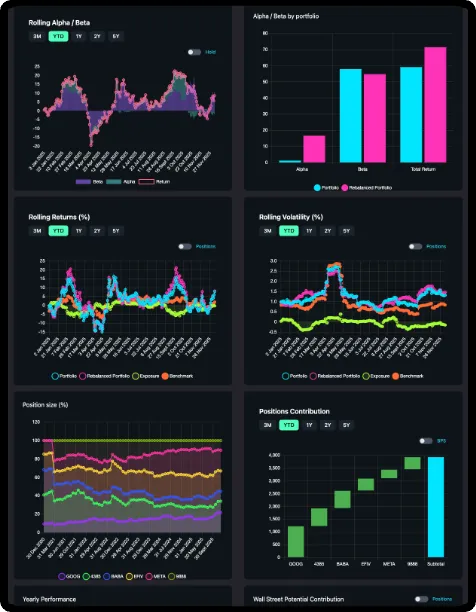

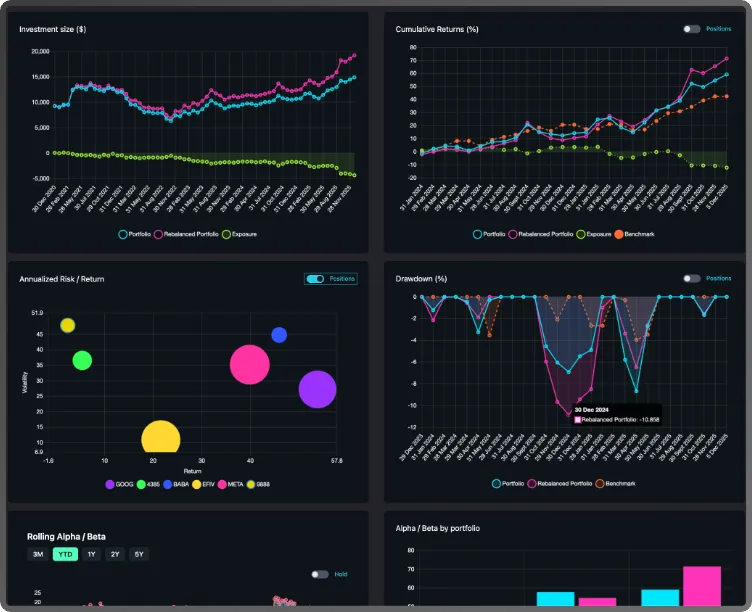

Every Insight, One Platform

Stop toggling between spreadsheets and apps. Get a holistic view of your wealth in seconds.

Master Your Portfolio in Minutes

Unify, analyze, and optimise all in one place.

I value the metrics available for all ETFs. The tables are helpful, allowing me to understand the numbers and calculation methodology. I also appreciate the ability to export CSVs, which is especially helpful for large stock portfolios.

Sivier Ben

The analytics overall are fantastic. As soon as I added a benchmark, the platform made sense and the numbers had more context. The 'Days to Liquidate' metric is genuinely interesting, it’s not something most retail investors usually think about.

Arya Razi

I found the AI insights accurate and aligned with my thinking, particularly the value-driven analysis for small cap and low book value stocks. The comparison to the benchmark, particularly in volatile periods, is very useful.

Josh O'Connnor

In the past, I felt there was simply too much going on with using a combination of tools. I prefer Palance as an all-in-one that gets me straight to the insights and guidance, no faffing about. I appreciate the recommendations and summaries, plus a broader view of my portfolio relative to a benchmark.

Luke Sye

I run everything on a big Excel sheet and it became too much work. I’m looking for a smooth rebalancing workflow that’s not overly complicated, something that helps me maintain my target portfolio structure and exposure breakdown without the heavy manual lifting.

Punit Bharadwa

I’ve built countless tools for partners to optimise and manage risk, yet didn’t have anything decent for myself. Analytics like this are a big help. I’m a big fan of the Correlation section and the look-through top positions table.

Tyler Barrymore

FAQs

Get answers to the most common questions about Palance.

Yes. We use industry-leading, secure data aggregation partners (like Plaid or similar) that provide read-only access to your account data. Palance never stores your login credentials and we cannot execute trades or move funds. Your security is our highest priority, which is why we only use encrypted, token-based connections.

We support major global institutions, including Interactive Brokers, Fidelity, Schwab, and most major international brokers (IBKR, XTB, etc.). For crypto, we integrate with major exchanges like Binance and Coinbase and many others. If your broker isn't listed, you can always use our secure manual upload feature.

Your broker focuses on providing very basic tracking services on the limited assets they offer. Palance is an unbiased, multi-asset analytics platform that provides institutional-grade analytics across all (almost) your assets (stocks, ETFs, funds, crypto) in one unified dashboard. We focus on advanced metrics typically reserved for professional asset managers.

Our analytics universe spans over 180,000 listings, including global stocks, ETFs, mutual funds, and major crypto assets. A: Our analytics universe spans over 180,000 listings, including global stocks, ETFs, mutual funds, and major crypto assets. This is also the universe you can use for benchmarking comparison.

The Free Tier allows you to manually create two portfolios (max 10 total positions) and access all our insights like basic Performance, Exposure, and Diversification Analysis. The Starter and Premium tiers allow you to connect to your brokerage accounts, upload more portfolios and positions, unlocks portfolio unification, and other more advanced features. For a full breakdown check out the pricing page in your profile.

There is no long-term contract. Palance is a flexible subscription service. You can upgrade, downgrade, or cancel your subscription at any time directly through your user profile settings. Changes take effect at the beginning of your next billing cycle.

We are an early-stage, user-focused platform driven entirely by community feedback. We are constantly iterating and upgrading. We offer priority support to all paid subscribers, and our team is always on hand to answer questions or help you onboard. We view our users as partners in building the next generation of investment tools.